Introduction

Traditionally, Alternative Investments like Hedge Funds, Private Equity Funds and Venture Capital Funds were sought after by Institutional Investors like Pension Funds, Endowment Funds and Family Offices. However, there has been increasing demand for these products from retail and high net worth investors.

Indian Markets are gaining Private Investors' confidence, after being ranked amongst the top 3 Most Preferred Destination by Global Investors, as per the Global Limited Partner Survey of Emerging Markets Private Equity Association, 2019 and 2020. Venture Capitalists (VCs) in India are willing to take the risk and provide startups with the initial capital required to bootstrap their businessmodels and on-board their first paying customers. India is now home to 73 unicorns across sectors and is poised to become the most favourable investment destination for foreign investors. The average time taken for a start-up to become a Unicorn has substantially dropped to 3 years for start-ups being formed in 2018-2020.

Category III AIFs and PMS Fund Managers understand the investment objectives and constraints of their clients and make suitable investments, as per the investment mandate. Hence, growth of such investment management services is imperative for the development of any economy, for investors to achieve favourable risk-adjusted returns. Category III AIFs in India have been investing the funds faster, in order to generate alpha by employing diverse trading strategies.

Need of the Course

There is a great demand for qualified professionals in the Alternative Investments market, to serve the Institutional Investors and High Net-worth Individuals allocating capital in big ticket sizes. The course will help you get practical knowledge on different legal structures permissible in Alternative Investment Funds, investment strategies deployed, applicable regulatory norms, due diligence practices, valuation policies, performance attribution and the accounting processes followed in this industry. Further, it provides you a practical experience of investing in startups, fund-raising process and the process of negotiations and start-up valuations.

Course Director

Mr. Archit Lohia, Industry Expert and Founder, CareerTopper.com

Credits, Time & Course Flow

This course is of 3 months duration having 3 Credits and 30 Instructional Hours. 2 Topics shall be exclusively conducted in workshop format. The first batch is starting from 1st weekend of January 2022 onwards.

The sessions will be offered in online live (Synchronous) mode.

Topic to be Covered in the Course

20 SESSIONS (One Session of 1:30 Hours)

- Investment Management Ecosystem and Role of Alternative Investments

- Fund Structures and Fee Structure

- Regulatory Landscape in India for Category I AIFs, Category II AIFs, Category III AIFs and PMS

- Angel Funds and Other Equity Forms of Private Capital

- SPACs and Structured Products

- Valuation and Performance Attribution - Private Equity Funds v/s Hedge Funds

- Term Sheet Negotiations for Start-up Founders

- Fund-raising Process for Start-ups and SMEs

- Start-up India and Growth of Private Equity in India

- Equity-based Investment Strategies for Hedge Fund and Case Studies

- Importance of REITs and InvITs

- Taxation Norms for Alternative Investments

- Risk and Return Measures for Alternative Investments

- Recent Growth in Alternative Investments – Indian and Global Markets

- New Investment Avenues:

- Arts and Paintings

- Sports

- Vintage Wine

- Stamps and Collectibles

- Films and Patents

Case Studies / Class Discussions

- Recent Growth in IPOs and activities in Unlisted Equities Market

- PIPE Funds and Crossover Funds in India

- Top Funds in India, by Industry, Size and Investment Strategy

- Common Hedging Strategies

- Important Factors to be considered before Investing in Hedge Funds

- Tax Residency Certificates and its use for Hedge Funds

- The Fate of International Financial Service Centres (IFSC) in India

- Future of REITs and InvITs in India

Course Advisors

A team of experts from AIMA's Board of Studies (https://resources.aima.in/chairman-andmembers-of-AIMA-bos-2018-2019.pdf) & CareerTopper (https://careertopper.com/)

Pedagogy

The course methodology will include interactive live lectures, discussions, live quizzes, case studies, expert learning and assessments. Additional readings will be provided for covering the contemporary aspects on an on-going basis.

Target Participants

Whether you want to make a career in the buy-side industry or become an Investment Manager, this program is the right one for you. Professionals who can seek this program are:

- Distributors and Marketing Professionals

- Research Analysts

- Family Offices

- Wealth Management Firms

- Institutions and HNI Investor

- Investment Advisors

- Accountants and Fund Administrators

- Trustees

- Custodians

- Investment Managers

- Freshers

- Lawyers and Tax Advisors

- Finance Students

Course Outcome

A niche topic like Alternative Investments is not covered in any of the B-School curriculum. However, it is important to understand this growing market, as it becomes an integral part of the Investment Management Ecosystem and the Start-up Ecosystem

On undertaking this course, the students will be able to:

- Understand risk-return profile of Alternative Investments, various asset classes within Alternative Investments and its growth history in the Indian and Global markets

- Discuss different type of investment products, diversification benefits, fund structures, market participants, due diligence parameters and marketing process of Alternative Investments

- Measure the risk and return parameters for an Alternative Investment Fund

- Examine the scope of growth for new investment avenues, like arts and paintings, Films, vintage wine, stamps, and SPACs

- Apply the Regulatory and Taxation norms to boost investments in Category III AIFs, Private Equity and Venture Capital, for the ultimate benefit of investors

- Understand how the investment patterns, cash flows and returns of Private Equity Funds are different from other traditional and alternative investments

- Identify equity and debt forms of Private Capital, and understand their performance attribution and valuation process

- Evaluate the Government initiatives taken to boost growth in Start-ups, Private Equity and Venture Capital and their impact on the investment and start-up eco-system

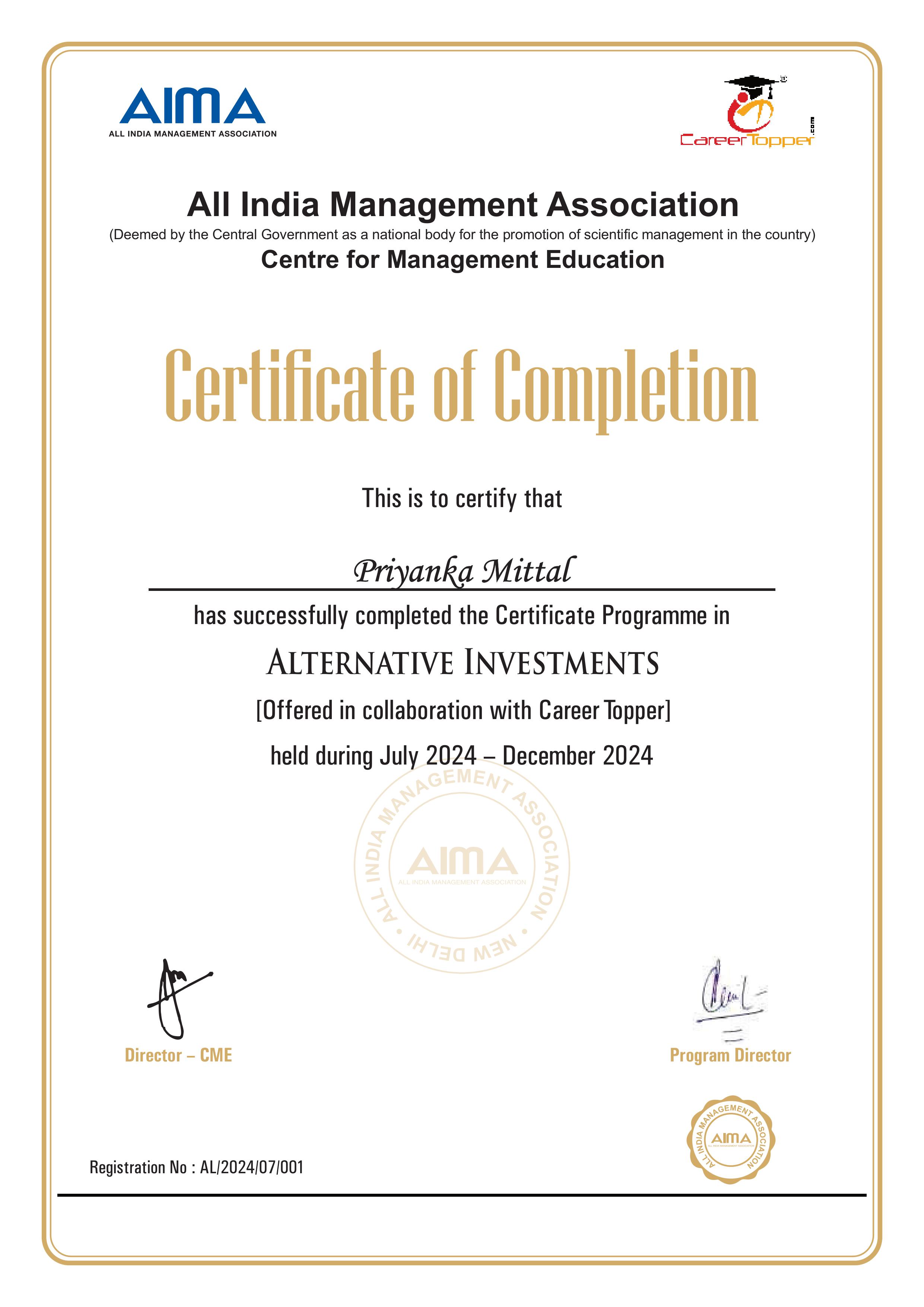

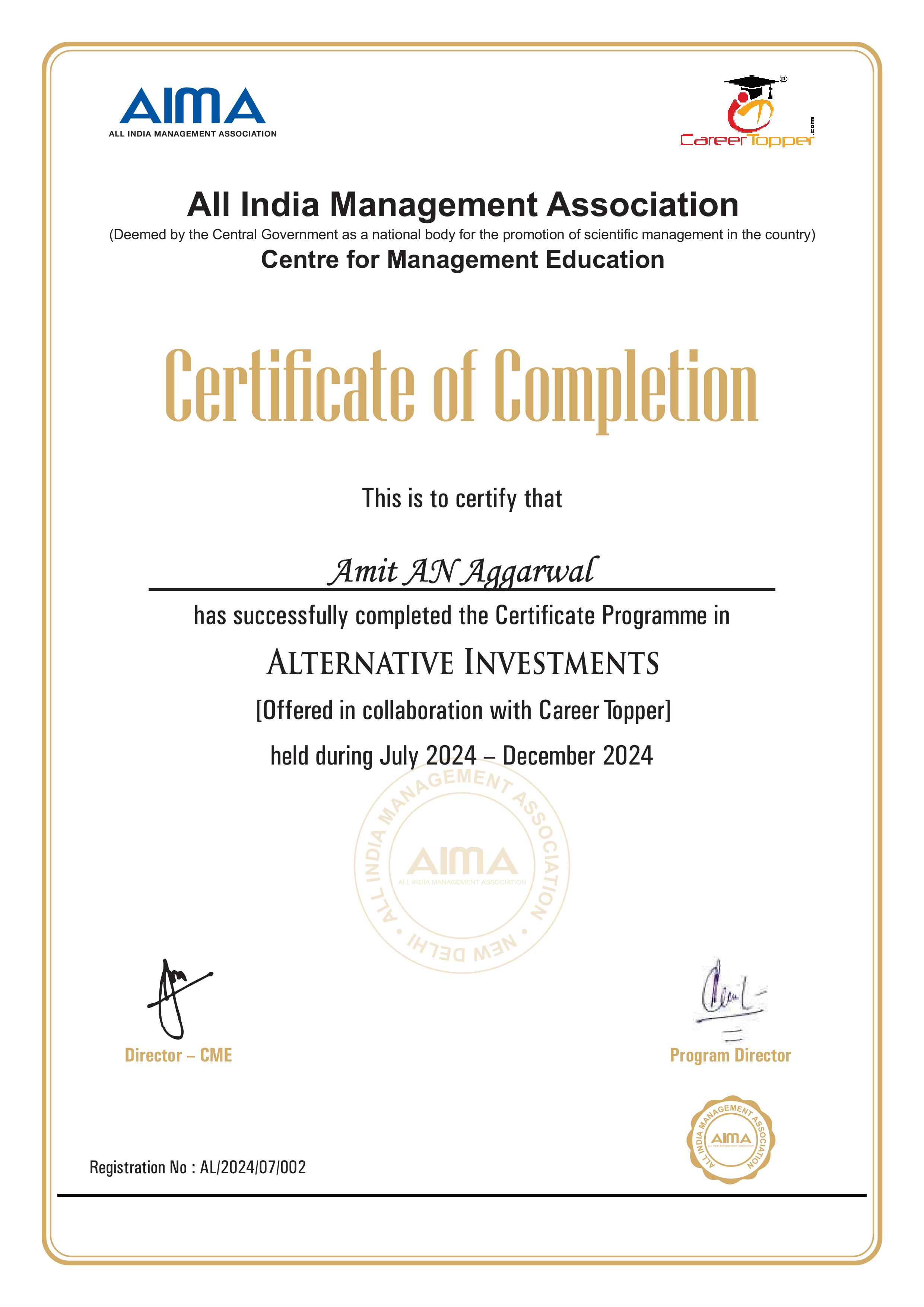

Assessment, Grading and Certification

The participants would be assessed on the basis of their performance in One online comprehensive examination (written test of 3 Hours duration) (Max. Marks – 100)

The participants will be graded on relative letter grading system. Those who obtain minimum B grade in Online Comprehensive Examination would be declared passed and awarded 'Certificate of Success' by ALL INDIA MANAGEMENT ASSOCIATION.

Credit earned in this course could be transferred to AIMA's PGDM program or to any other institutes'/universities' program as per the norms of UGC.

Participants not appearing in assessment for this course will be provided with 'Certification of Participation'.

For further clarification, please contact the undersigned

Prabha

Programs -Manager | Center for Management Education (CME)

All India Management Association

15 Link Road, Lajpat Nagar – Part III

Near Lajpat Nagar Metro Station, New Delhi – 110024

Phone : +91 11 47673000, 49868399 (Extn. 705)

Mobile : +91 7838935604

Email : psoloman@aima.in

Website : www.aima.in

.jpg)