Admissions open! APPLY NOW, PGCM Admission Helpline No. 7838935604 or email us on financialmodeling@

Why Aima

All India Management Association (AIMA) was established in 1957 (as a Society under the Societies Registration Act of India, 1860) as the national apex body of management profession with the active support of Government of India and the Indian Industry. By virtue of its contribution to the development of management profession in India over the last fifty years, AIMA is recognized for its national stature. The Centre for Management Education (CME) is the educational arm of AIMA which offers management education programs nationwide by distance learning through its Study Centers spread across the country. AIMA-CME, the pioneer of management education by distance learning in the country, is recognized by Distance Education Council (DEC) as a Distance Learning Institution to conduct management programs in the country.

Course Highlights

- Financial Modeling statement Analysis

- Alternative Investments

- Ubiquitous Learning

- Industry Interaction

- New Career Opportunities

Career Prospects

| FINANCIAL MODELLING | ALTERNATIVE INVESTMENTS |

|

|

Course Objectives

Financial Modelling - Enhances decision-making processes. Facilitates strategic planning for businesses. Enables professionals to predict and analyze financial trends. Supports capital raising, mergers, and acquisitions. Financial Modelling is a toolkit teaching essential money skills for running a business. It helps students understand and plan a company & finances, predicting future outcomes based on past performance. Financial models assist in decision-making, cash flow management, and assessing business performance.

Alternative Investments– There is an ever-increasing demand for qualified professionals in the Alternative Investments market, to serve Institutional Investors and High Net worth Individuals allocating capital in big ticket sizes. The course will help you get practical knowledge on different legal structures permissible in Alternative Investment Funds, investment strategies deployed, applicable regulatory norms, due diligence practices, valuation policies, performance attribution and the accounting processes followed in this industry. Further, it provides an integrated learning experience with Data Analytics and Machine Learning tools required to apply the investment strategies, perform analysis, and report data in this industry.”

Learn

- Excel

- Advance Excel

- Sensitivity Analysis, and Dashboard

- Capital Structure

- Integrated Financial Model

- Introduction to Financial Modeling

- Financial Statement Analysis

- Cross check the Balance sheet / Case Flow Statement Explain the DDM

- Prepare a full DCF Model

- VBA and much more.

- Investment Management Ecosystem and Role of Alternative Investments

- Fund Structures and Fee Structure

- Regulatory Landscape in India for Category I AIFs, Category II AIFs, Category III AIFs and PMS

- Angel Funds and Other Equity Forms of Private Capital

- SPACs and Structured Products

- Valuation and Performance Attribution - Private Equity Funds v/s Hedge Funds

- Term Sheet Negotiations for Start-up Founders

- Fund-raising Process for Start-ups and SMEs

- Start-up India and Growth of Private Equity in India

Program Highlights

- Government-recognized Course in Financial Modeling & Alternative Investments, in India.

- Integrated knowledge and application of Financial Modeling in this industry.

- In-depth training on the growth-oriented market of Alternative Investments.

- Exposure through Industry Experts, in Financial Modeling and Alternative Investments.

- Project Work in to get the desired industry-exposure and make you industry- ready.

Pedagogy

The course will be conducted through. interactive online sessions, covering the key concepts along with in-class assignments, discussions and presentations. Additional readings will be provided for covering the contemporary aspects on an ongoing basis contemporary aspects on an ongoing basis

Approval Of The Program

The PGCM program is approved by All India Council for Technical Education (AICTE), Ministry of Education, and Government of India.

For Whom

PGCM is open for both working professionals and fresh graduates who are aspiring to work.

Whether you want to make a career in the buy-side industry or become an Investment Manager, this. program is the right one for you. Professionals who can seek this program are:

- Distributors and Marketing Professionals

- Research Analysts

- Family Office Consultants

- Wealth Management Firms

- Investment Advisors

- Institutions and HNI Investors

- Accountants and Fund Administrators

- Freshers

- Finance Students

- Lawyers and Tax Advisors

- Trustees

- Custodians

- Investment Managers

Program Duration

The duration of the program is 1 year with two modules. The maximum duration to complete the program is 3 years.

Credits, Time, Course Flow.

The Credit For PGCM – Alternative Investments And Financial Modelling Program

| Semester 1 Courses/papers | 3 | 3x4=12 |

| Semester 2 Course/Papers | 3 | 3x4=12 |

| Capstone Project Work | Equivalent to 2 papers | 2x4=8 |

| TOTAL | 06 Papers | 32 Credit |

The course is of 12 months duration having 4 Credits and 120 Instruction Hours.2 Topics shall be exclusively conducted. The sessions will be offered in online live (Synchronous) mode.

Eligibility

Graduation (10+2+3) in any discipline from a recognised University / 3-year Diploma in any discipline if equivalent to graduation.

Program Fee

INR 25000/ (Program fee) + INR1000 (Prospectus admission cum fee)

Session Commences

January and July every year

Exam Schedule:

Exams are held in June and December each year. The exam schedule will be updated on AIMA website and Student Portal both.

Assessment And Certification

The participants will be required to appear for a Certification Assessment.

The assessment will comprise of online assignments (30% weightage) and final end term examination (70% weightage). Upon successful completion of the assessment,

All the participants shall be eligible to earn the Post Graduate Certificate in Management in Financial Modeling & Alternative Investments.

Program USP

- Approved by AICTE, Ministry of Education, and Govt. of India.

- Highly experienced Faculty from Academia & Industry.

- Complimentary AIMA student membership. Every student is entitled to receive an AIMA member certificate.

- Industry Interaction.

- Designed to accommodate busy learner schedule.

- Special invites to attend National level Seminars/Summits.

- New Career Opportunities

- Student Support for all academic & operational queries.

- Live Industry Interactive sessions.

- Placement Assistance from AIMA-Centre for Management Education.

Job Roles Expected After this Program

| Investment banking | Equity Research Analyst | Real estate | Venture capital |

| Corporate finance | Equity Research | Accountants | Debt syndication expert |

| Financial planning and analysis | Business Analyst | Commercial Banking | Financial Manager |

| Credit | Financial Analyst | Corporate Development | Financial Modeling course |

| Corporate finance | Portfolio Management | Merger and acquisition associate | Private equity |

| Investment management | Management consulting | Risk management | Project appraisal |

| Investment | Risk management | Banking | Hedge funds |

| Private equity | Internal Auditor | Finance |

Curriculum

MODULE-I

- Financial Management and Investments

- Introduction to Alternative Investments

- Hedge Funds and PMS

MODULE-II

- Financial Modelling & Data Analytics for Hedge

- Funds And PMS

- Private Equity, Venture Capital, and Angel Funds

- Financial Modelling and Data Analytics in Private

- Equity and Venture Capital

- Project Work

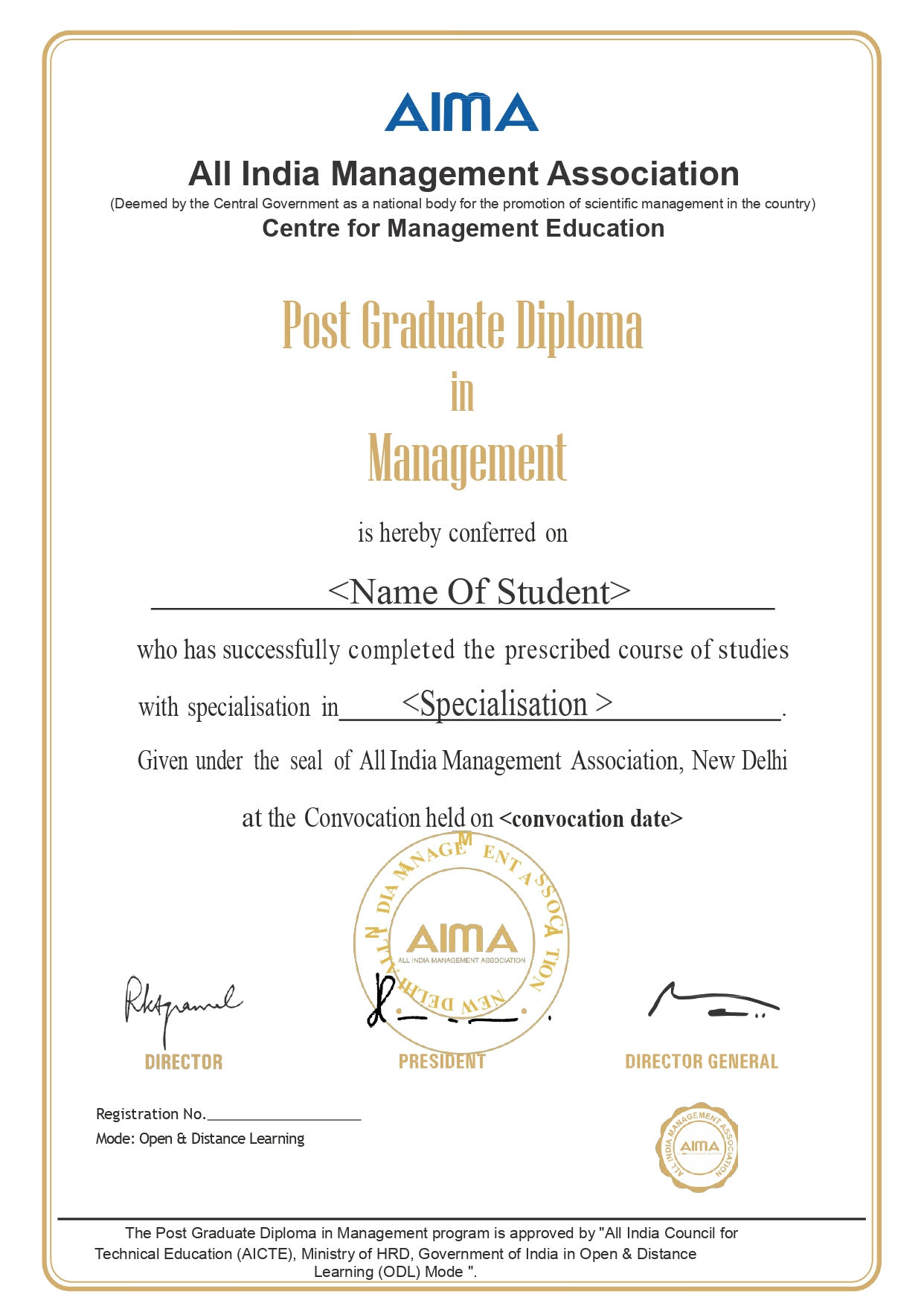

Sample Certificate

Key Indsutry Experts

Archit Lohia CFA, CA, CAIA, LLB – Founder & CEO at CareerTopper |

Archit is passionate about the Alternative Investments Market and aims at enabling finance professionals to hone the niche skills within this market. He is Chapter Executive of the CAIA Association India Chapter and an active member of the CFA Society, India. He has worked with Ernst & Young and BSE Ltd., in areas such as, Regulations, Compliance, IPO Process, Information Management Systems, Investment Analysis, Audit and Finance. His start-up works for Indian Regulators, Banks, Mutual Funds, Foreign Universities, Start-up Accelerators and a number of Training Institutes and B-schools. He likes to write books and articles on the Alternative Investments industry and is a regular speaker at national and international forums. |

Professor (Dr.) Kunwar Sanjay Tomar |

Professor (Dr.) Kunwar Sanjay Tomar has over 40 years of experience in first—and second-generation business enterprises, as well as academic teaching and consulting experience. His business interests include Equity Investment, IT services, credit counselling, web-based education, higher education institute establishment, marketing and related financial consulting, and security services. He has conducted numerous management development programs. He has written many research papers in ABDC and SCOPUS-indexed top international journals as an academician. His research interests include Value Investing, Foreign exchange and sectoral impact, Monetary Policy, Capital structure, and Leveraged Buyouts. He is working on projects for Machine Learning applications in Finance and Accounting applications based on AI. He works with FOSTIIMA and is also a visiting faculty member of AGBS Amity University and AIMA. |

For further clarification, please contact the undersigned

Ms. Prabha Soloman

Center for Management Education (CME)

All India Management Association

14, Institutional Area, Lodhi Road,

New Delhi - 110003

Phone : +91 7838935604 / 8178348863

Email : psoloman@aima.in

Website : www.aima.in

- Introduction to Alternative Investments

- Financial Management and Investments

- Hedge Funds and PMS

- Financial Modelling & Data Analytics For Hedge Funds And PMS

- Private Equity, Venture Capital and Angel Funds

- Financial Modelling and Data Analytics in Private Equity and Venture Capital

- Project Work

How to Apply Online?

Step 1: Open the Admission Form Link: https://apply.education.aima.in/

Step 2: Points to be taken care of while filling in the form online.

Session: Year January – June 2024

Program Name – F5 Alternative investments & Financial Modelling

Region: North

City: New Delhi

Nodal Centre Preference 1: 100- AIMA- CME Coordination Centre at Lajpat Nagar-3, New Delhi (For Delhi/NCR candidates) / 0 -All India Management Association (For outside Delhi/NCR candidates).

Documents to be uploaded while applying online: Attach your Graduation Mark sheet, Passport Size Photograph and proof of work experience which may include current organization’s appointment letter and relieving letter from the previous organization, if current organization work experience is less than 5 years.

Keep all the documents handy before filling up the Admission Form online.

Step 3: Select the Payment option Net Banking/Credit/Debit Card and make the fee payment online of Rs. 26,000.

Step 4: Email the payment acknowledgement to Program Manager on psoloman@aima.in